By Andreea Matson, Associate Director, at GSP/George Smith Partners, and appearing with permission of GSP. You may reach GSP/George Smith Partners at https://www.gspartners.com/

- As real estate professionals recover from the whiplash of 2025’s capital markets, executional certainty remains a priority on the principal side. Investors actively deploying capital are no longer in the market just for favorable terms or yield and are increasingly seeking capital providers that can offer flexibility, speed, and alignment.

- Credit unions and their affiliated Credit Union Service Organizations (CUSOs) are emerging as precisely that kind of capital, particularly for real estate investors operating in middle-market, secondary and tertiary markets, and across value-driven transactions.

- CUSOs are enabling credit unions to pool capital and participate in larger, higher-quality real estate transactions.

- Relationship-driven capital is becoming more valuable, and tapping into this capital source is one of the many ways GSP augments capital deployment strategies for clients.

When capital markets are constrained, the definition of “bankable” narrows quickly. Higher rates, tighter credit standards, and reduced balance sheet flexibility at traditional banks have created financing gaps across many segments of commercial real estate. In this environment, credit unions, which are historically relationship-driven, are stepping into opportunities left behind by conventional institutions. Increasingly, they are doing so not only through their own balance sheets, but through CUSOs, which allow multiple credit unions to combine capital, manage risk, and access transactions that would otherwise be out of reach.

The Rise of CUSOs as Pooled, Alternative Capital

CUSOs are increasingly functioning as a conduit for pooled credit union capital into commercial real estate. By combining balance sheet capacity across multiple institutions, CUSOs allow credit unions to scale their exposure, diversify risk, and participate in higher-quality transactions that exceed the limits of any single credit union.

In practice, this pooled approach enables:

- Participation in larger loan sizes and higher-value assets

- Geographic diversification beyond a single credit union’s local footprint

- Exposure to institutional-grade sponsorship and repeat sponsors

- Deployment into senior loans, pari-passu structures, and select structured positions

Rather than competing directly with banks or private credit funds, CUSOs increasingly occupy a complementary position in the capital stack. Their mandate emphasizes downside protection and sponsor alignment, making them particularly well-suited for stabilized assets, light transitional deals, and value-driven strategies in secondary and tertiary markets.

As banks continue to retrench, CUSOs are increasingly becoming a “quiet middle” in the capital markets: less visible than private debt funds, but materially more flexible than traditional lenders.

How Credit Union Terms Differ from Banks

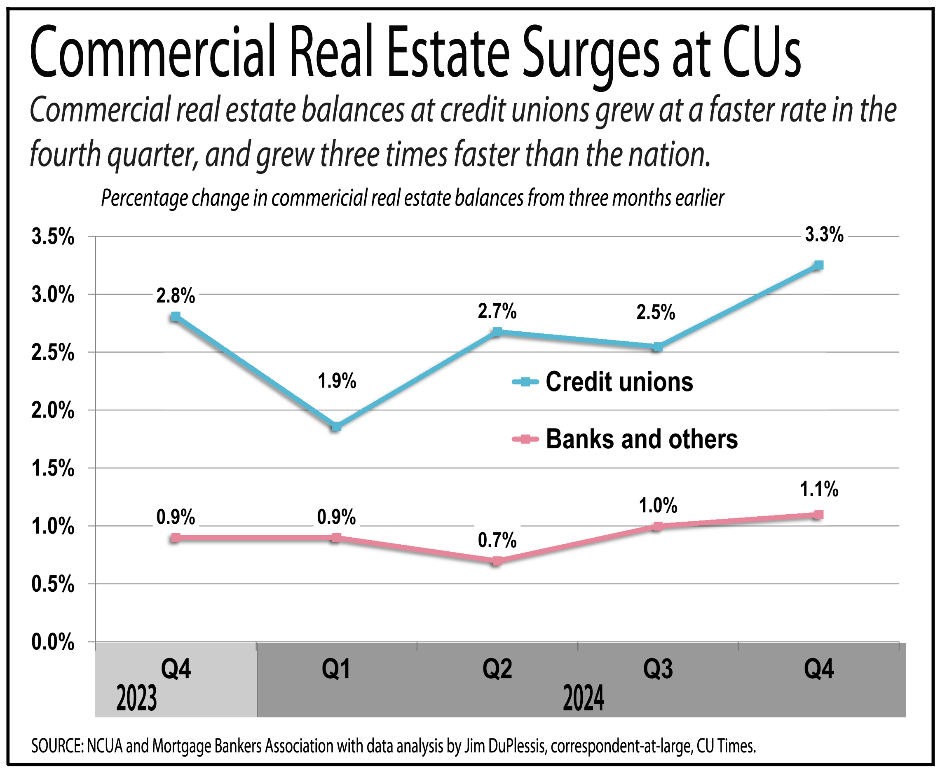

CRE balances at CUs and CUSOs continue to grow and are doing so at a much faster rate than bank balances. This dry powder glut is a perfect opportunity for active investors to diversify their lending structures and partners.

While credit unions are often grouped with banks, their lending terms and priorities can differ dramatically, creating both advantages and tradeoffs for borrowers. Translating these factors effectively help us guide our clients towards optimal capital stack buildouts in every deal we take on.

Key Advantages

- No Pre-Payment Penalty: Credit unions generally do not impose PPP structures, which can materially improve all-in economics. Pre-payment penalties can be common on the lending side, and credit unions offer loans with fixed-rate surety along with flexibility to pay the balance at anytime without incurring a fee.

- Relationship-driven underwriting: Greater flexibility around borrower profile, property type, and story.

- Willingness to lend where banks have paused: Particularly in small-balance and transitional deals.

- Growing rate competitiveness: While historically priced wider than banks, many credit unions and CUSOs have become increasingly competitive as they expand CRE allocations.

Key Considerations

- Pricing can still be slightly higher: Especially for higher-leverage or non-core assets.

- More conservative leverage in most cases: Lower LTC/LTV is common.

- Decision Risk: Credit committee and approval processes can be less standardized.

- Less appetite for highly complex structures: Particularly in ground-up development.

Why This Matters in Today’s Market

As banks continue to narrow their lending parameters, CUs and CUSOs are filling gaps not by taking more risk, but by underwriting differently. For sponsors, the tradeoff is often a modest premium in exchange for certainty of execution, flexibility, and access to capital that might otherwise be unavailable.

The key is knowing when these structures are accretive, how to position a transaction for approval, and how to weigh cost against execution risk particularly as capital markets continue to normalize in 2026.

How GSP Fits Into This Landscape

At GSP, our ability to leverage distinct capital relationships is precisely what allows us to access these funding structures. Credit unions and CUSOs are not broadly marketed capital sources. They are relationship-driven, trust-based partners. Successfully sourcing and structuring capital with them requires:

- Deep understanding of lender mandates

- Alignment between sponsor strategy and credit union risk appetite

- The ability to position deals in a way that resonates beyond pure metrics

As a capital markets advisor, this environment reinforces the value of relationship capital and strategic capital formation. It is not just about finding capital, it is about curating the right capital stack for the deal, which balances pricing, flexibility, and execution certainty.