Originally published by the Federal Housing Finance Agency on 9/13/2019 at https://www.fhfa.gov/Media/PublicAffairs/Pages/New-Multifamily-Caps-9132019.aspx

HIGHLIGHTS AND BENEFITS OF NEW MULTIFAMILY CAPS

- FHFA is revising the structure of the caps applicable to the multifamily loan purchases of Fannie Mae and Freddie Mac (the Enterprises).

- The new caps eliminate loopholes, provide ample support for the market without crowding out private capital, and significantly increase affordable housing support over previous levels. The Enterprises multifamily business should play a more countercyclical role in the market.

- The new caps will be $100 billion for each Enterprise, a combined total of $200 billion in support to the multifamily market, for the five-quarter period Q4 2019 – Q4 2020.

- The new caps apply to all multifamily business. There will be no exclusions.

- To ensure a strong focus on affordable housing and traditionally underserved markets, FHFA directs that at least 37.5% of the Enterprises’ multifamily business be mission-driven, affordable housing.

- Loans that finance energy and water efficiency improvements will be considered conventional business, unless they meet other mission-driven affordability requirements (see revised Appendix A).

- To maintain market stability, FHFA also expects the Enterprises to manage their business to remain in the market throughout the entire five-quarter period.

BACKGROUND

- In 2014, FHFA set a cap on the Enterprises’ conventional (market-rate) multifamily business.

- The purpose of the cap is to support liquidity in the multifamily market, especially in affordable housing and traditionally underserved segments, without crowding out private capital.

- To encourage Enterprise financing in affordable housing and underserved market segments, in 2014, FHFA also excluded several categories of business from the cap.

- In 2016, loans that finance certain energy and water efficiency improvements (“green loans”) were added to the list of multifamily business categories excluded from the caps.

THE OLD CAPS WERE NOT WORKING AS INTENDED

- In recent years, the multifamily market has grown, and the Enterprise share of multifamily loan originations expanded considerably. This has put the Enterprises in a pro-cyclical role in the multifamily market. Enterprise share of new multifamily originations increased from approximately 36% in 2015 to 49% in 2017 and, based on preliminary estimates, 42% in 2018.

- Between 2015 and 2017, the overall multifamily market grew roughly 14%, and Enterprise multifamily loan purchases grew roughly 54% – 41% more growth than the overall market.

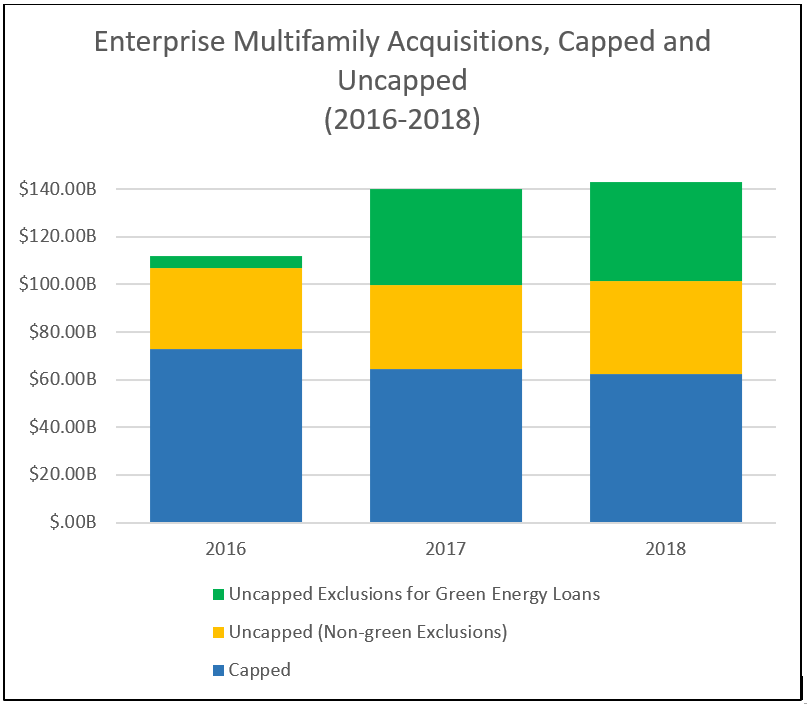

- The recent growth in Enterprise multifamily market share is largely attributable to the exclusion of green loans from the caps starting in 2016.

- By 2017, and continuing in 2018, approximately 50% of Enterprise production was excluded from the cap altogether, largely driven by the addition of green loans as an excluded category.

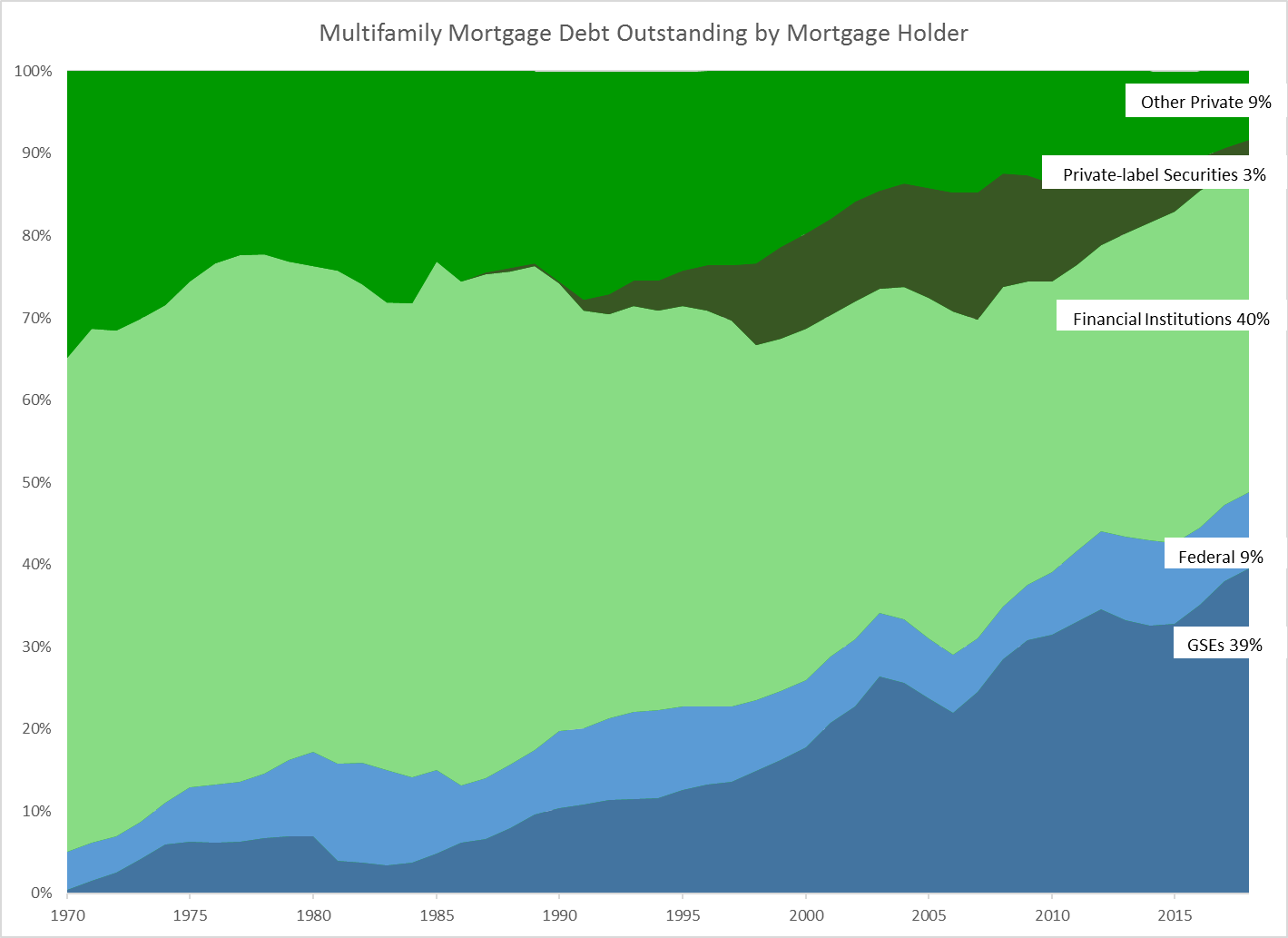

- The increase in Enterprise share of multifamily loan purchases since 2015 compounded the longer-term growth of the Enterprises in the multifamily market under conservatorship. Enterprise share of mutlifamily debt outstanding increased from approximately 25% at year end 2007 to approximately 40% by year end 2018.

| Note: “Other Private” includes mortgage debt owned by mortgage companies, REITs, credit unions, individuals, and other entities. “Financial Institutions” includes mortgage debt owned by depository institutions and insurance companies. “Federal” includes mortgage debt owned by Ginnie Mae, the Federal Home Loan Banks, and other federal instrumentalities. Mortgage debt owned by a PLS trust is included in “Private-label securities.” (Source: Federal Reserve, Mortgage Debt Outstanding) |

| Note: This reflects loans that qualify in more than one category, and therefore the total numbers are greater than actual Enterprise multifamily loan purchase totals in each category and overall. (Source: FHFA Conservatorship Scorecard Progress Reports, 2016 – 2018) |