By Fotios Tsarouhis/MultiFamily Housiang News | April 3, 2024

How will Fannie and Freddie’s new mandates impact multifamily in 2024?

In today’s high interest rate environment, GSEs are shaping up to be more important than they have been in years.

Even as FHFA has scaled back Fannie Mae and Freddie Mac’s combined loan cap to a combined $140 billion, new rules are making the deployment of capital to affordable and workforce housing easier. Each lender’s Low-Income Housing Tax Credit investment caps has been raised from $850 million to $1 billion annually. Meanwhile, debt issued to workforce housing projects is exempt from the $140 billion cap, creating an opportunity for increased investment in the sector.

The reduction of the 2023 cap of $150 to $140 billion in 2024 may ultimately be of little consequence. FHFA’s decision “is not cause for concern to me for two reasons”, said Emily Schultz, senior vice president, head of Fannie Mae originations, at Berkadia. “Firstly, neither Fannie Mae nor Freddie Mac came close to hitting their caps last year.”

Both entities ended last year at plus or minus $50 billion, said Schultz, noting that the Mortgage Bankers Association projects that the multifamily market will rise by 25 percent in 2024. That puts the agencies’ respective volumes at approximately $62.5 billion—well below the new lower cap.

Secondly, she observed, “the FHFA has been clear that they’ll be monitoring the caps relative to market size, and cap increases could be available if deemed necessary.”

Marc Cesare, senior managing director of originators at NewPoint Real Estate Capital agreed that the supply of GSE funds should match current demand. “With the macro challenges we are facing, along with workforce housing being exempt from the cap, we do not expect the $140 million cap to have much of an impact on multifamily lending this year,” he said.

Still, an eventual increase has its appeal. “Our hope is that number does go up because I think at some point there’s going to be a significant increase in transaction volume, and Fannie and Freddie want to be there,” said David Link, executive vice president and regional managing director at NorthMarq Capital.

Dangling a carrot

The FHFA is concentrated on workforce housing and “the carrot” they’re using is allowing this to be uncapped business, Schultz noted. But workforce housing is a key part of the GSEs’ mission, with both likely to focus on it “regardless of the cap exclusion carrot.” The agency said that workforce housing loans preserve affordable rents, usually without depending on public subsidies. Affordability levels of workforce housing correspond to 80 percent to 120 percent of AMI, depending on the market. The move is not surprising, Link concurred, but it is nonetheless reassuring in this climate. “It’s important that they do as much of that as possible because, in the near term, banks’ balance sheets aren’t in great shape and they’re going to struggle,” he said.

LIHTC caps raised

The increased LIHTC investment caps for both GSEs from $850 million to $1 billion, meanwhile, is a significant and welcomed jump, Cesare said. One that comes with “a continued emphasis on supporting mission-related transactions, especially those that the FHFA has identified as historically having difficulty attracting investors.”

Any investments by the GSEs above $500 million must be for such transactions, including deals backing housing in “Duty to Serve”-designated rural areas, supporting mixed-income housing or providing supportive housing, Cesare noted.

“This increase comes at an important time as the demand for LIHTCs has softened over the past year, resulting in a lower average price per credit and corresponding decrease in property level subsidy,” said David Leopold, senior vice president, head of affordable housing at Berkadia, predicting that the additional $300 million will provide “a marginal” improvement affordable housing investment.

How vital are the GSEs?

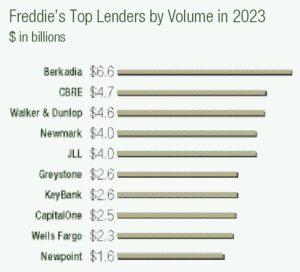

Fannie Mae and Freddie Mac were seen as critical lenders in 2023, able to parcel out financing while other lenders were heading for the hills. This dynamic seems likely to hold in 2024 with both firms playing a major role in keeping multifamily liquid. This is especially true in the workforce and affordable sectors, said Cesare, though there is not a total dearth of capital. “As of early 2024, we are seeing that capital outside of the agencies is still available,” he remarked. “Albeit it is a bit more expensive than agency pricing.”

Indeed, the GSEs, which last year updated their underwriting standards to be more selective, are operating in a much different landscape than the one of the early 2020s.

“To some extent, I believe the GSEs will continue to be the stable source of capital in 2024,” said Schultz. “However, since the beginning of the year, we’re seeing more activity from non-agency debt sources.” One of the main ones is insurance companies, which “have new allocations that they’re looking to deploy,” particularly for Class A, lower leverage business, and private capital.

CMBS, meanwhile, is mounting a comeback. “We’re witnessing spread compression in that space,” said Schultz. “With respect to banks, activity is ramping up, but due to capital requirements and slow pre-pays, it’s still somewhat a case-by-case scenario.”

The GSEs are likely to play an even more important role in 2024 than they have in recent years, according to Link: “Banks were incredibly active in ’21, ’22, in the first quarter of ’23, and then they pulled back dramatically and, all of a sudden, what’s left is the life companies.”

While those insurers will be important in financing multifamily projects, Fannie Fae and Freddie Mac will likely play the largest role, said Link. “I think they’re more able to get really competitive on rates when it comes to workforce housing, affordable housing.”

2024 and beyond

The outlook for the year will depend on macroeconomic variables, including the Fed’s next moves and the economy’s overall health. Closer to home, the number of projects coming online will likely affect the sector’s performance.

“Although the market hasn’t fully found its new normal, it’s getting closer,” Schultz said. “Buyers and sellers continue to become more aligned on pricing, as the bid/ask gap has shrunk over the past year. The refinance-to-acquisition ratio is another gauge of market health, and we’re seeing that move closer to 50/50 as 2024 applications come in, which is positive.”

The Federal Reserve’s actions will have a major impact on financing. “The numbers that Fannie put out in 2023 were challenged largely because of the aggressive rise in interest rates,” Link said. “People just weren’t ready to transact.”

This could change as the central bank lowers rates, as they are expected to do. “I would be surprised if the transaction volume for the agencies was as low as it was in 2023,” Link added. “We feel pretty optimistic that there will be more transaction volume, and largely because the banks are going to force activity to get things off their books.”

The potential for delinquencies is also a consideration for multifamily. Factors impacting the likelihood of increased defaults include “maturing floating rate debt, maturing interest rate caps, new supply and moderating fundamentals in certain markets,” according to Cesare. Public policy will also have an impact on the market, with lenders paying close attention to monetary and regulatory considerations, as well as November’s presidential and congressional elections.